“CumEx” is a controversial dividend arbitrage stock trading practice currently under investigation in several European jurisdictions with, to date, limited involvement from the UK authorities. It allegedly caused significant losses to various EU treasuries, which are currently engaged in civil proceedings, regulatory settlements and criminal proceedings, including against two former London traders who are currently on trial for tax fraud in Germany.

“CumEx” is a controversial dividend arbitrage stock trading practice currently under investigation in several European jurisdictions with, to date, limited involvement from the UK authorities. It allegedly caused significant losses to various EU treasuries, which are currently engaged in civil proceedings, regulatory settlements and criminal proceedings, including against two former London traders who are currently on trial for tax fraud in Germany.

Many London stock loan desks and inter-dealer brokers were involved in CumEx trading, also known as dividend arbitrage trading (“CumEx”), and the Financial Conduct Authority has conducted a review into the practices of some firms involved with dividend arbitrage.

This article sets out in broad terms:

- the background to CumEx,

- its operation,

- the legal issues surrounding beneficial ownership of shares and taxation,

- the justifications raised in defence of the trading, and

- practical considerations for UK firms, their employees and agents connected to CumEx.

Background

Under certain double taxation treaties, overseas investors are entitled to a refund of dividend withholding tax (“WHT”) on shares held in domestic companies. It is noted that not all EU jurisdictions operate a WHT scheme and, in particular, the UK does not operate such a scheme.

CumEx is one of the WHT refund models, which use rapid share transactions to contrive successive multiple ownership of shares to facilitate multiple refunds of WHT from European tax authorities.

- Share transactions are agreed prior to the dividend record date (“cum-dividend”) and settled after the dividend record date (“ex-dividend”) (“transaction A”).

- Between agreement and settlement, the shares are short sold [by the purchasers in transaction A] with a dividend compensation payment (“a manufactured dividend”), which mirrors the dividend payable on the shares (“transaction B”). Short selling is selling securities at a time when the seller does not hold them for delivery in the future (“forward sale”); delivery is made possible by borrowing the securities.

- This gives the impression that the shares were short sold cum-dividend, when in fact they were in fact ex-dividend.

- The related transactions take place over a short period and this may confuse the tax authority as to the beneficial ownership of the shares.

- Multiple WHT refunds are claimed on the shares, by the purchaser and short purchaser under both transactions A and B which should have been paid only once.

In this way, the CumEx transaction is made possible where the dividend record date is not timed to coincide with the settlement cycle in that market. In these cases, the record date of the dividend is on the business day preceding the ex-date. The settlement convention (typically at this time shares would settle 3 days after execution) meant that the share transactions executed one, two or three days before the ex-date would settle after the record date.

In the above examples, the buyer of the shares would not receive the dividend from the company, because on the record date the company’s registrar would still see the shares as being physically held by the seller. The buyer is nonetheless entitled to the dividend and would claim the net dividend amount from the seller (a manufactured payment). In CumEx transactions, the seller would not own the shares prior to the execution but rather execute an “uncovered short sale”.

After the dividend record date, the seller would borrow shares via a stock lending agent in order to cover the short sale. Short sales are all over-the-counter transactions and can have shorter settlement cycles than the buy/sell transactions.

If a trade were executed on one day before the ex-date (i.e. on the record date) then it would settle two days after ex-date (ex-date + 2). On ex-date, ex-date + 1 or even ex-date + 2, the seller can source a borrowing of shares to settle to their account on ex-date + 2, i.e. in time to satisfy the onward delivery to the buyer. These shares would have legitimately been seen as belonging to the client of the stock lending agent on the record date, and hence that client would have received the dividend from the company (the real dividend) and would have been entitled to claim their respective WHT entitlement.

In addition, the buyer of the shares – as the trade was executed before the ex-date, i.e. cum-dividend – may also be entitled to claim their respective WHT entitlement, in addition to the manufactured dividend received from the seller.

The seller of the shares implicitly receives the dividend through the cum-dividend price of the shares (the price of the shares adjusts by the quantum of the dividend on the ex-date) and pays this away via the manufactured dividend payment.

Thus, some experts have likened CumEx transactions to parents claiming a benefit for two or more children when there is only one child in the family. Of course, where appropriate tax loopholes are available, it may amount to mere sharp practice or simply effective trading. However, fraud has also been alleged.

CumEx commenced in Germany the 1990s1, when a loophole in the tax code was identified. The essence of the loophole is that WHT reclamation is available not just for dividends but also for “manufactured dividends”, i.e. contractual payments by market counterparties equal to actual dividends paid by issuers.

This loophole was exploited by highly sophisticated networks of equity traders, tax advisors, lawyers and investors until it was closed in 2012.

As with the alleged manipulation of the Libor benchmarks, CumEx flourished both before and after the financial crisis as a profitable line of business, but the spotlight has only subsequently shone on these practices.

The CumEx trading model migrated from Germany to Austria from 2011 to 2012, then to Denmark from 2012 to 2015 and finally to Belgium and Switzerland until 20172. Italy was also targeted. It is understood that CumEx trading was sought to be introduced into other jurisdictions, but the necessary legal and tax advice may not have been favourable.

It is widely reported that CumEx caused losses of €55.2 billion including an estimated €31.8 billion in Germany, €17 billion in France, €4.5 billion in Italy and €1.7 billion in Denmark3.

German authorities are currently investigating around 100 domestic and foreign banks on suspicion of tax evasion arising out of the practice. In August 2019, the offices of the operator of the Frankfurt stock exchange, Deutsche Boerse AG, were searched as part of these investigations4.

Several financial institutions have made regulatory settlements with the authorities and one (Maple Bank) has closed down as a result of the claims brought by BaFin, the German financial regulator.

On 4th September 2019, two former London investment bankers appeared at Germany’s biggest post-war tax fraud trial. Martin S. and Nick D. are accused of structuring 33 CumEx transactions that cost the treasury and ultimately Germany’s taxpayers €450 million between 2006 and 2011. The trial is ongoing.

The trial will seek to determine the legality or otherwise of these transactions under German law5 and whether there are implications under criminal law.

Operation

Key Dates for Dividends

In order to understand how the opportunity for CumEx trading arises and the significant gains that could be made from reclaiming the WHT, it may be useful to understand the key dates in the dividend calendar. These dates are also important for the purpose of understanding whether beneficial ownership of the shares (or at least the right to receive dividend) was in fact transferred as part of the CumEx trading process, a critical issue in terms of determining any right to reclaim WHT.

Declaration date

The declaration date is the date that the dividend is announced by the company’s board of directors. On this day, the company will give information about the size of the dividend, the date of record and the payment date. The company usually has a legal responsibility to pay the dividend once it has been declared.

Ex-dividend date

To ensure that one is a shareholder by the record date, it is necessary to buy shares at least two/three day(s) before the ex-dividend date. This is because of the standard settlement period for equities throughout Europe tends to be two or three working days.

Thus, the ex-dividend date in that trading example would be the record date minus one/two/three day(s).

Accordingly, traded positions at the start of business on the ex-date represent the beneficial owner who is entitled to the dividend, whether that is paid as a real dividend (if they are also the holder of record) or paid as a manufactured dividend (if the shares have not settled by close of business on record date). It is this beneficial owner who is entitled to apply for a WHT reclaim.

Record date

The record date is used to determine who is on the share register and therefore entitled to the dividend. The company sets the date of record after it has announced that it will pay a dividend. At the close of business on the record date, the registrar takes a snapshot of who is physically holding the shares (the holders of record) and pays the real dividends to these holders. Recent changes in most markets mean that the record date is timed to ensure that cum-dividend trades, i.e. those executed before ex-date, should have settled before the close of business on the record date. The opportunity for CumEx existed where this was not the case, as described above. Share registers are kept electronically. Settlement is the delivery of title to shares against payment in accordance with the sale contract.

Payment date

The payment date is the date dividends are actually paid. The length of time between the initial record date and payment date varies between stock exchanges but is typically anywhere between the ex-date and one or two months.

Potential for tax avoidance schemes

As demonstrated above, the fact that the settlement cycle of the shares (e.g. T+3) is not consistent with the date convention for the dividend (implicitly T+0), combined with the potential to borrow shares with a shortened settlement cycle, creates the opportunity for 2 parties to appear to be the beneficial owners of the same individual shares in the eyes of the relevant tax authorities.

It is not difficult to see how the opportunity arose for banks to develop substantial trading platforms to take advantage of any perceived loopholes in the taxation regimes within countries operating a WHT regime.

What is alleged to have occurred is that the opportunity arose for multiple reclaims of a single WHT payment.

A CumEx Illustration

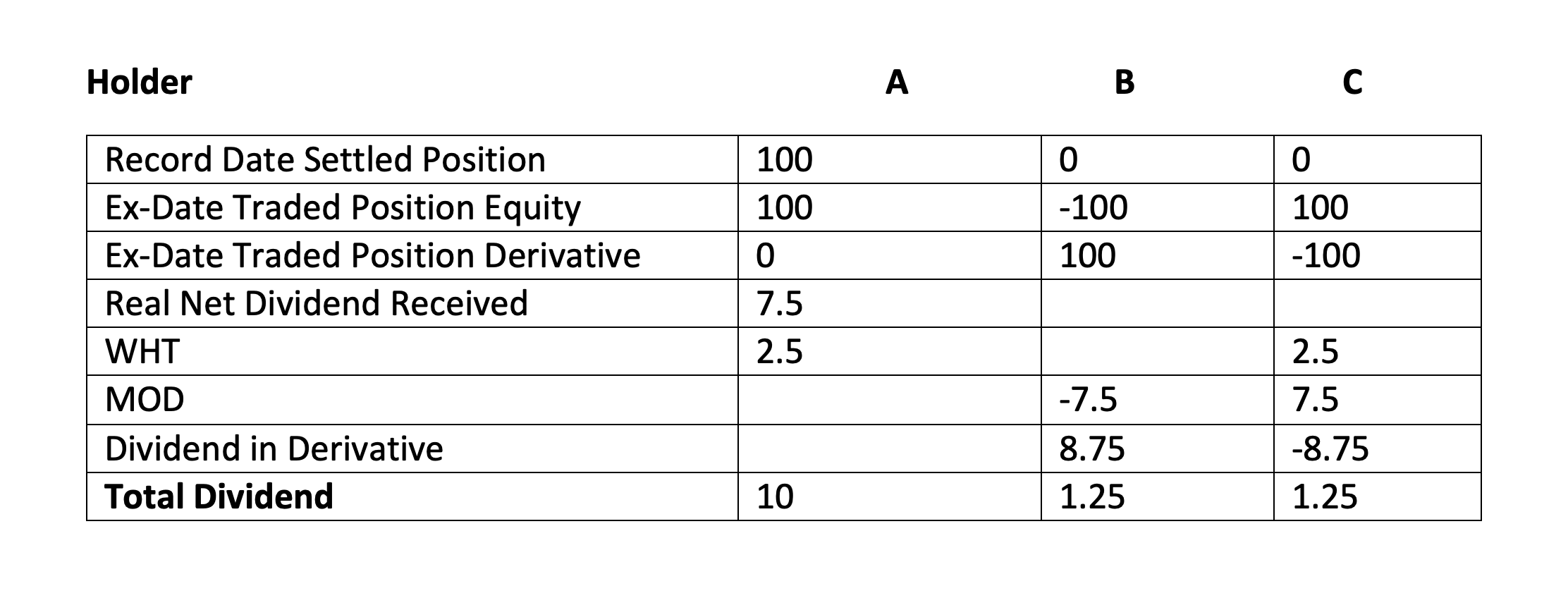

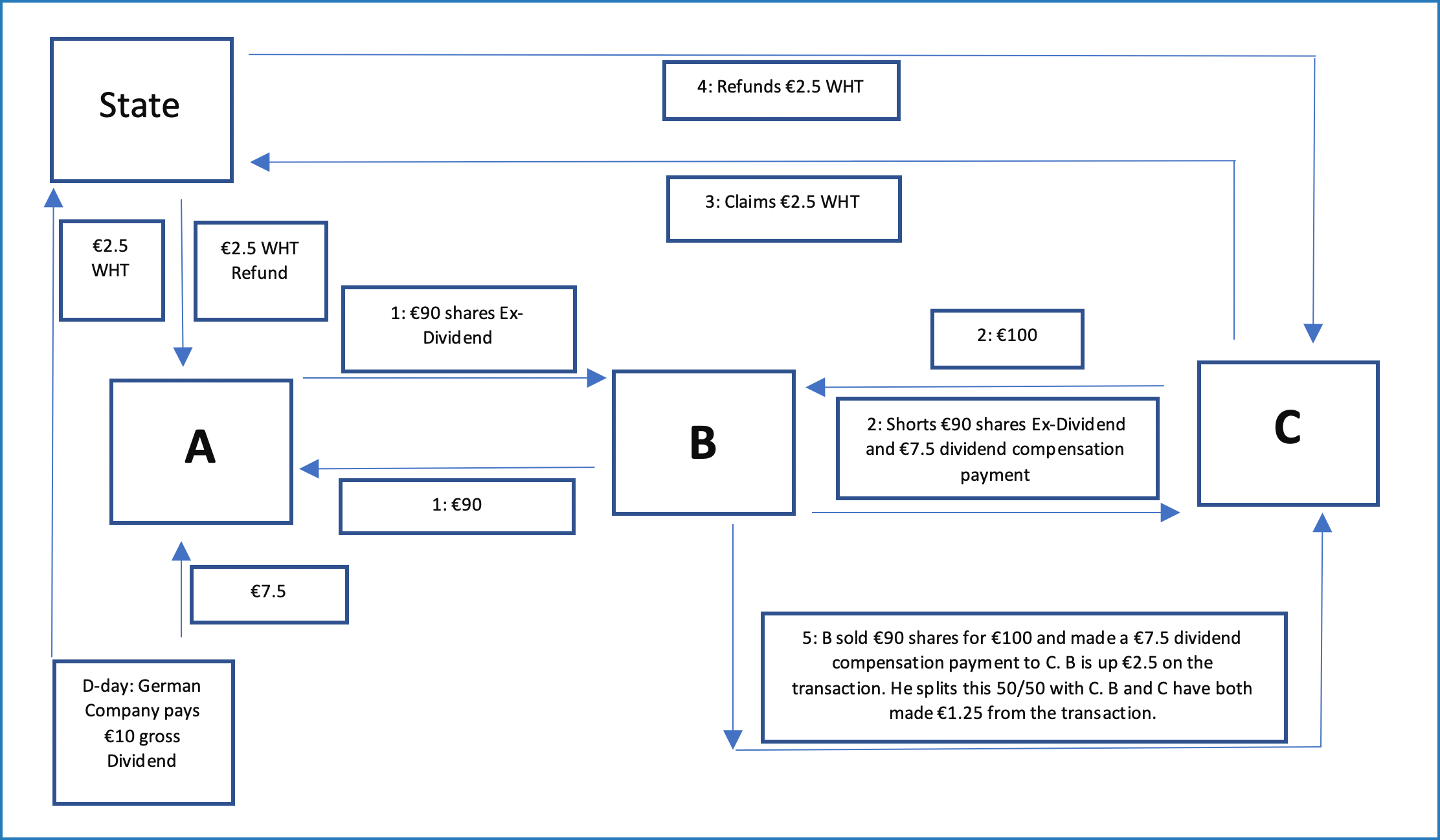

While there are many variants of CumEx trading, a typical hypothetical illustration is set out below.

A and C are shareholders entitled to receive 100% of the dividend. A owns a share that is worth EUR 100 and where a dividend of EUR 10 is announced (i.e. net dividend of EUR 7.5 and total WHT of EUR 2.5).

With regards to A, at the close of record date A is holding the share and appears on the record date share register and so will receive the real dividend. As A remains the beneficial owner at the start of trading on ex-date, A is entitled to the WHT reclaim.

Separately B sells one share to C for EUR 100 before the ex-date (i.e. one day before record date). B does not own any shares and will therefore need to borrow shares via a stock loan trade in time for the delivery of the shares on ex-date + 1.

At the same time, both B and C enter into derivative transactions (probably via a third party), where B gains long exposure to the underlying equity. Hence any share price change on the movement on the share will be hedged by the market to market component of the derivative. Embedded in the derivative is also a manufactured overseas dividend (“MOD”) component, whereby C implicitly pays e.g. 87.5% of the dividend to B (i.e. the net dividend of 75% and half of the 50% WHT).

At the close of business on the record date neither B nor C hold any shares and therefore the register does not reflect their holding and neither receives a real dividend. C is entitled to the dividend, as it purchased the shares cum-dividend and it therefore claims the net dividend of EUR 7.5 from B and reclaims EUR 2.5 from the German tax authorities.

At a suitable time after ex-date, B buys back the share (now trading at EUR 90) from C and unwinds the derivative.6

The tables below aim to set out the above hypothetical transaction:

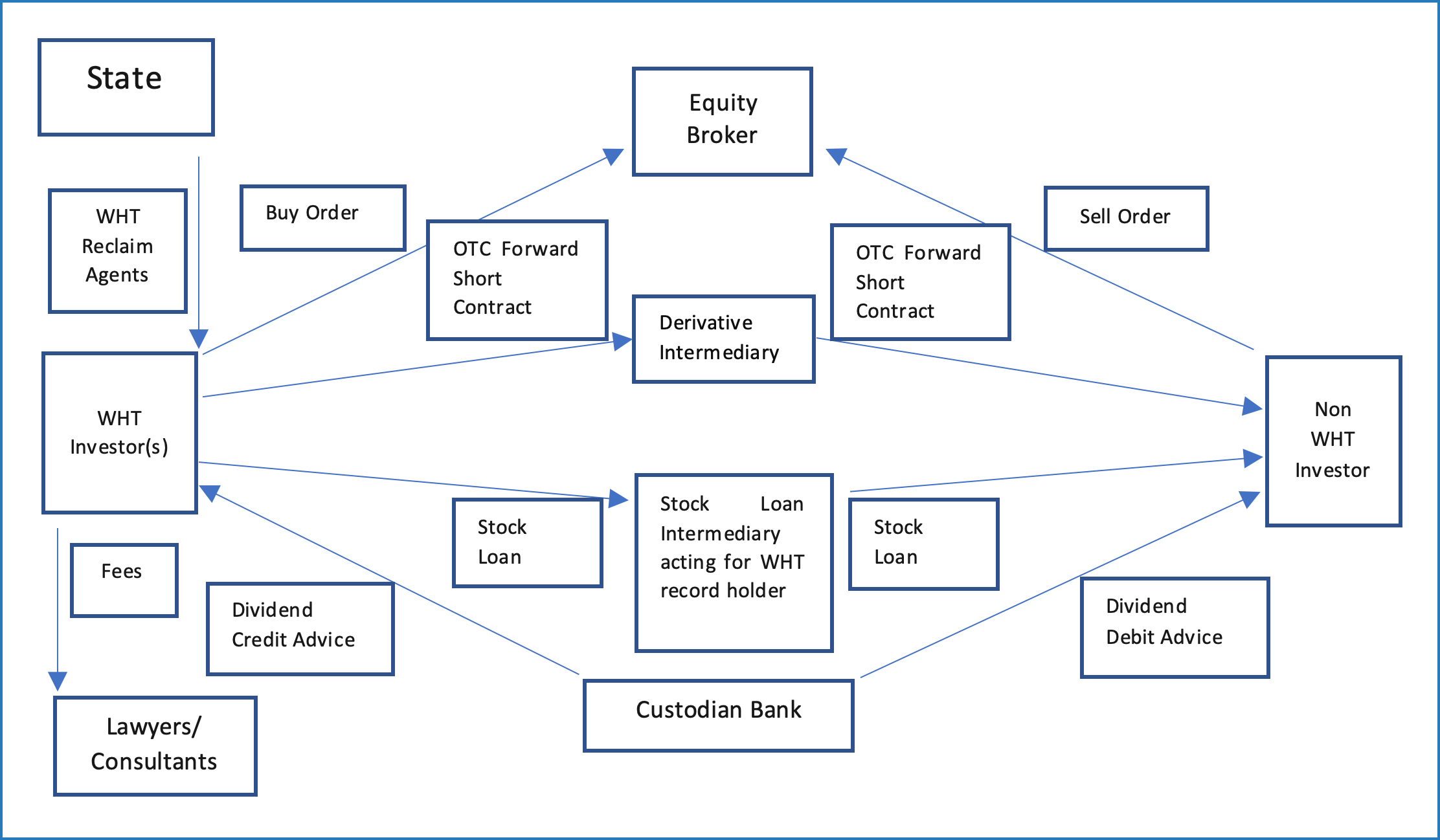

The Wider Marketplace

“… It is a high-grade, collaborative market of banks, lawyers, tax advisors, investors, lobbyists. … It is an industry of hundreds of people…”7

In reality, CumEx involved a highly complex network of parties, providing liquidity and services essential to its operation.

CumEx transactions commonly involved four trade legs:

- purchase of the stocks;

- sale of the stocks;

- collateralised stock loan agreements to facilitate the short sale, and;

- over the counter (“OTC”) forward agreements.

Several parties were essential to the transactions, including finance and stock lending providers. Access to liquidity in both the cash and the forward market was essential.

Each trade leg required a professional intermediary, including:

- a broker to execute the purchase and/or sale of stock, and;

- an equity finance agent to execute the stock borrowing.

Legal and tax professionals provided advice and consultancy services. Immediately prior to key dates, high volumes of loans were taken out and several parties obtained legal and tax advice to seek to ensure the propriety of their activity.

Reclaim agents would submit WHT refund applications on behalf of offshore investors, obtain the refunds and distribute them accordingly. Multiple offshore investors would apply for refunds based upon allegedly falsified dividend credit advices from custodian banks and refund applications from reclaim agents.

Ownership of the shares was impossible to ascertain, given the speed of the transactions:

“… the sales are very, very, fast. It is done in seconds… and so it is difficult for the fiscal tax services to know who exactly holds the stock when the dividend is paid…”8

The timing of the shorts and dividend compensation payments had the potential effect of muddying the true beneficial ownership of the stock:

“… the traded shares were traded with, cumdividend, but it was a short sale so settlement took place ex-dividend… and that meant that the short seller had to deliver the shares with a compensation payment, with a manufactured dividend, and that manufactured dividend was not subject to a withholding tax although the custodian bank of the buyer issued a second tax voucher…”9

To understand how the CumEx trading model was carried out in all its variants, often with the effect of playing a “zero sum” game, in the sense that all of the trades had the cumulative effect of ultimately netting each other out, it will be necessary to understand the parties and their various roles.

Parties and Intermediaries

There is set out below a diagram which shows the relevant parties, their intermediaries and the relevant direction of travel of the various financial agreements.

The overseas investors were often in fact US pension funds, known as 401ks, which benefitted from favourable tax treatment and entitled a reclaim of WHT on foreign paid dividends. SKAT, the Danish tax authority, has brought civil fraud proceedings in the US against many of the 401ks which acted as the overseas parties to the CumEx trades seeking the recovery of WHT paid to them: see for example https://law.justia.com/cases/federal/district-courts/new-york/nysdce/1:2018cv04047/493285/80/.

Documentation

CumEx trading used unremarkable documentation in line with established market custom and practice and then effectively spliced them together to achieve the trading aims to maximise the recovery of the WHT:

- stock trades were executed by regulated brokers under standard confirmations;

- forward short trades were executed under standard International Swaps and Derivatives (“ISDA”) agreements;

- stock lending and borrowing transactions were executed under standard Global Master Securities Lending Agreement documentation;

- dividend credit advices were produced in accordance with market practice, and;

- custodian bank fee agreements were in line with market standard rates for the services they provided.

Of course, the fact that standard market forms were being used and that global securities were now held in a dematerialized form (ie electronic recording rather than in physical certificated from) would have lent a degree of propriety and ease to conduct CumEx trading.

Legal issues surrounding beneficial ownership of shares and taxation

Was beneficial ownership transferred?

This poses the question as to whether the CumEx transactions transferred the beneficial ownership of the shares and the rights under them, including:

- the right to share in the company's profitability, income, and assets;

- a degree of control and influence over company management selection;

- pre-emptive rights to newly issued shares, and;

- general meeting voting rights.

The Cologne tax court has recently answered this question, holding that, under German law, in the case of an over the counter short sale, the share purchaser would not become the beneficial owner of the shares to be delivered at a later stage at the settlement of the purchase agreement10.

While it falls outside the scope of this brief article to provide a detailed analysis of the application of the English courts’ approach to beneficial ownership of shares and, in particular, any dividend rights and their application under any double taxation treaties, it is likely to prove a critical issue in terms of any English court’s consideration of the validity or propriety of any reclaim of WHT, subject to the application of any other domestic law in the country from which the WHT was reclaimed.

The meaning of beneficial ownership of shares has been most extensively examined in J Sainsbury Plc v O’Connor [1990] BTC 363. While the case is rather more important in describing the circumstances in which beneficial ownership exists rather than attempting any all-embracing definition of the term, beneficial ownership will not exist without equitable ownership. As Millett J said:

“Beneficial ownership involves more than equitable ownership. It requires more than the ownership of an empty shell bereft of those rights of beneficial enjoyment which normally attach to equitable ownership.”

In terms of double taxation treaties, it may be worth noting the dicta that beneficial enjoyment of dividends is an important feature of beneficial ownership of shares. It was noted that the right to beneficial receipt of dividends which are declared must be distinguished from the right to cause them to be declared. Consequently, beneficial ownership may have nothing to do with control.

More recently, it was held that the concept of an “interest in securities” must denote something more than a contractual right or economic interest in them: see SL Claimants v Tesco Plc [2019] EWHC 2858 (Ch), in which the term “interests in securities” was held to connote beneficial interest per Hilyard J at para. 85:

“In my judgment, the expression denotes something more than a mere personal or contractual right; the expression “ultimate beneficial owner” captures the position of the investor as the owner of “a right to a right” held through a waterfall or chain of equitable relationships…”

There have been a number of decisions regarding the definition of beneficial ownership under double taxation treaties with the UK, including the Netherlands, French and Italian Supreme Courts. In the Royal Dutch Shell case (Netherlands, HogeRaad (Supreme Court), 6 April 1994, BNB 1994/217) the taxpayer was a UK resident who acquired dividend coupons detached from the Royal Dutch Shell shares in respect of dividends which had been declared but not yet paid.

The Supreme Court held that the question as to who the beneficial owner is must be answered at the time the dividend is payable and not at the time it is declared. The treaty did not require that the beneficial owner of the dividend must also be the owner of the shares, but rather whether it became entitled to the distribution.

Beneficial ownership was also examined by the French Conseil D’état (Supreme Administrative Court) in Ministre de l’Economie, des Finances et de l’Industrie v Société Bank of Scotland (29 December 2006), 9 ITLR 683. Article 9 of the France-UK Income Tax Treaty (1968) provided for repayment of dividend tax credits under the then French imputation system for taxation of companies and their shareholders. Certain financial arrangements were deemed to have been entered into for the sole purpose of obtaining the benefit of the dividend tax credit payment under the France-UK Income Tax Treaty.

The court expressed the view that beneficial ownership was an anti-abuse concept, saying:

“[T]he direct recipient of income is not entitled to obtain the advantages granted by international tax treaties if he is not the ultimate recipient of this income and if he has only received it in the status of intermediary for another person to whom the income is destined to be transferred in one form or another….

I think nevertheless that this case reveals that the notion of beneficial ownership cannot be reduced to cases of transfer of intended benefits and that, by its nature, it encompasses situations of fraud on the law. It appears to me in effect quite natural that the recognition of a fraud on the law leads one to reject the image portrayed by an arrangement.”

This case may be more useful as a guide to French anti-abuse doctrine than the meaning of beneficial ownership, since it sought to recharacterize the financial arrangements that had been made.

Oxoid International Limited (Italian Supreme Administrative Court Decision No. 4164 of 20 February 2013) concerned repayment of dividend tax credits under art. 10(4) of the Italy-UK income tax treaty. An Italian company paid dividends to its UK parent company by conversion of the obligation to pay the dividends into an interest-bearing loan. The Italian Supreme Court rejected the UK company’s claim to the tax credit repayment on the basis of beneficial ownership saying:

““[The treaty] is clear in determining that the UK company receiving the dividends has to be the beneficial owner in the sense that it has materially received the dividends, as it appears from the wording of Para. 2 and 4 of Art. 10 of the Convention, which refers to the notion of ‘paying’ and ‘receiving’ dividends.”

It remains to be seen how the courts will fully determine the question of beneficial ownership and its impact on the propriety of the reclaimed WHT in CumEx, whether in the courts of Europe, England and indeed the US, where litigation remains ongoing.

New rules

As noted above, even after attempts were made to close certain tax loopholes by some EU tax authorities, it appears that the CumEx trading model may have continued. More recent attempts have been made by legislation in certain EU jurisdictions to clarify the issue of beneficial ownership through statutory provision, rather than the interpretation of complex financial agreements. For example, recent Belgian legislation has made a raft of new requirements in order to limit any reclaims of WHT and imposes a sixty-day holding requirement on any shares. These measures became effective on January 22, 2019 (Law of January 11th, 2019 on Combatting Tax Fraud and Tax Avoidance Regarding Withholding Tax).

Justifications given for the CumEx trading model

Those involved in CumEx have raised multiple justifications for the practice similar to those that were raised for Libor manipulation, including that it was standard market custom and practice, was not illegal and that its participants were not dishonest.

Others claim that CumEx merely exploited a loophole in the state’s tax law, the responsibility for which lay ab initio with the state, that they acted in reliance on legal advice, satisfied reporting requirements and were not responsible for the legal, tax or investment activities of other participants.

Investors such as German businessman Carsten Maschmeyer blame the banks for not disclosing the source of their investment return11.

A further justification could prove to be the tacit acceptance of CumEx by the German state as a profitable line of business for banks. This is perhaps indicated by two factors.

On one hand, State Commissioner August Schäfer was made aware of CumEx by whistle-blowers in 199212. Over time, several whistle-blowers came forward but were ignored.

On the other, the enormous trading volume created by CumEx around dividend record date was either ignored or not investigated fully by the German tax authorities or BaFin.

BaFin’s executive director Elisabeth Roegele defended CumEx when Chief Legal Officer of Dekabank13 but in March declined to comment on its legality or otherwise14.

In the course of the Libor investigations, third party disclosure from the Bank of England allegedly demonstrated that it knew of the manipulation but took no action. A similar story may arise with CumEx in Germany.

Of course, different parties to the CumEx trading model may well have their own independent bases for suggesting a lack of any wrongdoing. For example, the custodians of the relevant shares or the brokers will no doubt suggest that they bear no responsibility for the tax affairs of any shareholders or customers. Lenders to the scheme will not necessarily know the purpose of any trading carried out backed by their security. The shareholders themselves may have had limited actual knowledge of the counterparties involved and how the reclaims for WHT were made. The reclaim agents may have relied upon the accuracy of the information provided to them prior to making any reclaim of WHT. All will claim that they had understood that such trading would not have occurred without at least one party receiving the appropriate tax advice as to its propriety.

Considerations for UK Firms

“… traders at the stock loan desks, quite often in London, pulled all the strings and they traded quite extensively… in the UK, the traders needed to evade the system and they… used SnapChat on their private mobiles… these messages disappear immediately so you don’t leave any trace behind…”15

Financial Conduct Authority Review

In 2017, the Financial Conduct Authority (“FCA”) reviewed a number of inter-dealer brokers, settlement agents and custodians involved in dividend arbitrage, CumEx in all but name, which places shares in various jurisdictions to either minimise WHT or generate WHT reclaims.

The FCA sought to establish whether this trading amounted to market abuse and found that:

“… a small number of firms may not have undertaken a sufficiently detailed assessment of the purpose and nature of transactions that appear to be linked to WHT reclaims… some firms may not have identified the risk posed by contrived or fraudulent trading for the purpose of making illegitimate WHT reclaims…”16

FCA Requirements

Firms involved with dividend arbitrage must comply with the FCA’s requirements, which require them to:

- conduct their business with integrity, due skill, care and diligence;

- organise and control their affairs responsibly and effectively;

- have adequate risk management systems17;

- maintain adequate policies and procedures to ensure regulatory compliance and to counter the risk of the firm’s involvement in financial crime, and;

- regularly assess the adequacy of counter money laundering systems and controls18.

Crucially, FCA principle 11 requires:

“… firms to deal with their regulators in an open and cooperative way, and to disclose to the appropriate regulator appropriately anything relating to the firm of which that regulator would reasonably expect notice…”19

Accordingly, firms must monitor new and existing clients and transactions and self-report anything that would reasonably be expected to be of interest to the FCA.

This reporting requirement is reinforced under Article 16 of the EU Market Abuse Regulation, effective 3rd July 2016 (“MAR”), whereby firms are obligated to report anything that “could constitute” market abuse to the FCA “without delay”20.

The FCA Review concludes:

“… If, when reviewing processes, you identify any areas of concern, we expect your firm to conduct an assessment and also to consider whether you should disclose the details to us under Principle 11…”

ESMA interim report and consultation

In July 2019, the European Securities and Markets Authority (“ESMA”) published its preliminary findings of its review into WHT reclaim schemes.

In October 2019, ESMA published a consultation which closed on 29th November 2019 which considers on behalf the European Commission (“EC”) potential changes to the MAR regime to tackle perceived gaps in the regulatory framework concerning WHT reclaim schemes. Whilst the consultation is careful to avoid any specific characterisation of the schemes, it is seeking views on whether to amend MAR to give NCAs (National Competent Authorities) the power to investigate and sanction unfair behaviours carried out by regulated entities that represent a threat to the integrity of the financial markets as a whole, beyond insider dealing and market manipulation and to grant NCAs the possibility to cooperate and share information with tax authorities upon request, including an exchange of information across the EU. ESMA is due to provide its recommendations to the EC in spring 2020.

Due Diligence, Compliance and Co-Operation

The FCA rules, taken together with MAR, clearly indicate that firms potentially exposed to or involved in dividend arbitrage should conduct extended due diligence on relevant clients and transactions.

Where any clients or transactions raise any concerns, these should be properly documented and considered for reporting to the FCA.

It is likely that a prudent UK firm with CumEx exposure will be considering carefully a thorough review of its operations, including the potential for carrying out an internal investigation.

Pro-active co-operation with the authorities may also become relevant if the FCA were to make any referral to the Serious Fraud Office (“SFO”) to conduct any investigation into CumEx.

A guilty finding in the German trial may signal SFO involvement and corporate co-operation plays heavily into its charging decisions21.

Ultimately, consideration of corporate co-operation with the SFO may yet have to be considered depending upon the events taking placing in Germany under the recent new guidance published concerning deferred prosecution agreements22.

If the history of the Libor investigations and prosecutions is to be considered as a reasonable benchmark, the outcomes for individuals at UK firms will likely be seen to be somewhat haphazard. Some will likely face no or limited inquiry by any of the relevant authorities, others may face some form of FCA regulatory intervention. It remains too early to tell, if any UK firms or its individuals will face more serious proceedings before the English courts or indeed if others will face further proceedings in Europe.

Either way, while enacted after the height of CumEx trading, the provisions of Part 3 of the Criminal Finances Act 2017 should be considered as an important statutory framework. In particular, while noting the distinction between legitimate tax avoidance schemes and tax evasion, UK firms will wish to ensure there are no breaches of the provisions of section 46 - failure to prevent facilitation of foreign tax evasion offences – and that all reasonable measures have been taken to seek to prevent any such facilitation.

Updated 5th December 2019

For further information in relation to this article or David Stern, please contact: Chambers Director, Dave Scothern on: dscothern@5sah.co.uk

David Stern

David is a barrister with 30 years’ experience in financial crime. Joint Head of the Regulation and Business Crime Practice Group at 5 St Andrew’s Hill, he has acted in many high-profile proceedings in England, especially cases brought by the Serious Fraud Office and the FCA as well as internationally in Europe and the US.

David was at the forefront of the LIBOR benchmark manipulation scandal, successfully representing several clients, including traders and brokers in SFO criminal prosecutions and investigations. He is also considered to be a leading expert in the recent Cum-Ex dividend arbitrage trading scandal.

David is ranked in Chambers & Partners as a leader in the field of Financial Crime (London) as well as the Legal 500 for Business and Regulatory Crime (including Global investigations) (London). He is also Special Counsel to Edmonds Marshall McMahon.

1 Christoph Spengel, University of Mannheim: EU 11/18 Meeting: 19:40 hours

2 https://www.youtube.com/watch?v=aPXomQaSMxU&t=3s

3 https://www.youtube.com/watch?v=s-iPsK7iBBY at 01:30 mins

4 https://www.bloomberg.com/news/articles/2019-08-27/deutsche-boerse-offices-searched-in-german-cum-ex-tax-scandal

5 https://www.theguardian.com/business/2019/sep/20/the-men-who-plundered-europe-city-of-london-practices-on-trial-in-bonn

6 CumEx Files : comment arnaquer le fisc avec la Bourse

7 Der Insider # CumExFiles: 46:00mins

8 Eva Joly MEP 2009-19, CumEx Files, nouveau scandale de l'évasion fiscal: 06:05 mins

9 Professor Christoph Spengel, TAX3 ECON: 19:34 hours

10 https://lpscdn.linklaters.com/-/media/files/document-store/pdfns/2019/august/linklaters_august_2019_international_tax_round_up.ashx?rev=b614c00f-4cce-4d92-89b5-0fdc9a23d830&extension=pdf

11 DOKU - CUMEX – Jahrhundertcoup: Angriff auf Europas Steuerzahler: 11:00 mins

12 https://www.zeit.de/1994/36/mobbing-auf-hohem-niveau/seite-2

13 https://www.handelsblatt.com/finanzen/banken-versicherungen/cum-ex/gerhard-schick-im-interview-frau-roegele-sollte-die-zustaendigkeit-fuer-saemtliche-cum-ex-vorgaenge-abgeben/24055682.html?ticket=ST-64421402-PXh6hj1lbegWrtaK0bOT-ap6

14 https://www.handelsblatt.com/finanzen/banken-versicherungen/cum-ex/cum-ex-steuerskandal-bafin-vizepraesidentin-verteidigte-in-ihrem-frueheren-job-umstrittene-aktiendeals/24049784.html?ticket=ST-52173151-DDC2BIPfJlZm2SYdzub6-ap6

15 Christian Salewski TAX3 ECON: 20:01 hours

16 https://www.fca.org.uk/publication/newsletters/marketwatch-52.pdf

17 FCA Principles for Business PRIN 1, 2 and 3

18 SYSC 6.1.1R (Adequate Policy and Procedures), SYSC 6.3.3R (Adequate Systems and Controls)

19 https://www.handbook.fca.org.uk/handbook/PRIN.pdf

20 https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32014R0596&from=EN

21 Serious Fraud Office Operational Handbook – Corporate Co-operation Guidance

22 https://www.sfo.gov.uk/publications/guidance-policy-and-protocols/deferred-prosecution-agreements/